Moving Global Commodities

Securely. Strategically. Seamlessly.

Providing the operational architecture that enables reliable, cross-border commodity trade.

Our Foundation

Working with Global Industry Leaders

How We ExecuteThe Cosmo House Methodology

Commodity Sourcing & Market Access

Connecting verified buyers and suppliers across global markets through transparent, compliant, and execution-ready trade frameworks.

Transaction Design & Execution

Designing end-to-end trade structures that translate commercial intent into executable, institution-ready transactions.

Operational Architecture & Coordination

Orchestrating logistics, inspection, banking, and documentation into a unified, execution-ready trade system.

Risk & Compliance Discipline

Supporting documentation readiness, custody protection, and regulatory alignment at every stage of a transaction.

Our Operational Framework

Assess & Qualify

We evaluate market conditions, commercial feasibility, counterparty credibility, and operational readiness to ensure every transaction is viable and execution-ready.

Design the Transaction

We design the commercial, operational, and documentation framework that transforms opportunity into a clear, institution-ready transaction.

Coordinate Execution

We align logistics, inspection, banking processes, and documentation to ensure disciplined, secure, and seamless execution through completion.

Every Engagement Is Built On

Execution Discipline

Every transaction follows a structured workflow designed to minimize ambiguity and execution risk.

Institutional Readiness

All processes are designed to meet the standards of regulated banks, inspection agencies, and counterparties.

Operational Independence

We do not hold client funds or act as a financial institution, ensuring neutrality, flexibility, and transparency.

Documentation Integrity

Clear, complete, and compliant documentation underpins every stage of execution.

Counterparty Accountability

We require operational readiness and verified participation from all involved parties.

Risk-First Design

Risk management is embedded at the design stage, not treated as an afterthought.

Client & Partner Perspectives

See more reviews on

Our Approach

Cosmo House LLC is an independent global trade firm focused on moving physical commodities across international markets with clarity, structure, and execution discipline. We work at the point where commercial opportunity becomes real-world action, sourcing opportunities, connecting counterparties, and designing the frameworks that allow complex transactions to move from intent to completion.Our role is to bring order to complexity. Global commodity trade involves many moving parts, including buyers, suppliers, logistics providers, documentation systems, and financial institutions. We design and coordinate the operational structure that aligns these elements into a single, executable process. Every engagement is built around precision, accountability, and institutional standards of execution.We believe strong trade execution starts with thoughtful design. Before anything moves, the structure must work. That means clear workflows, defined responsibilities, reliable documentation, and alignment with professional banking and compliance environments. Our focus is on making transactions workable, scalable, and resilient.Cosmo House was built on the idea that credibility comes from consistency. We value disciplined process over improvisation, clarity over complexity, and structure over assumption. These principles shape how we approach every transaction and every partnership.Our experience is grounded in real cross-border execution, institutional banking coordination, and regulatory operating environments. This has shaped us into a firm that thinks in systems, anticipates risk, and prioritizes execution quality at every stage. We are not driven by speculation or scale for its own sake, but by building reliable frameworks that support sustainable, professional trade.Cosmo House LLC is incorporated in Delaware, USA, with professional engagement across East Asia, the Middle East, the Americas, and Europe.At its core, Cosmo House exists to make global commodity trade more dependable. We turn complexity into structure, strategy into execution, and opportunity into outcomes.

Precision. Compliance. Operational Excellence.

Cosmo House LLC provides advisory and facilitation services for complex, high-value international trade transactions. Our focus is on helping clients structure transactions that are operationally sound, legally compliant, and aligned with established institutional banking practices.Operational Boundary: > Cosmo House does not act as an investment manager, fund custodian, broker-dealer, or capital intermediary. Our role is to support transaction readiness, structure, and execution in coordination with the client’s chosen banks, legal counsel, and professional advisors.

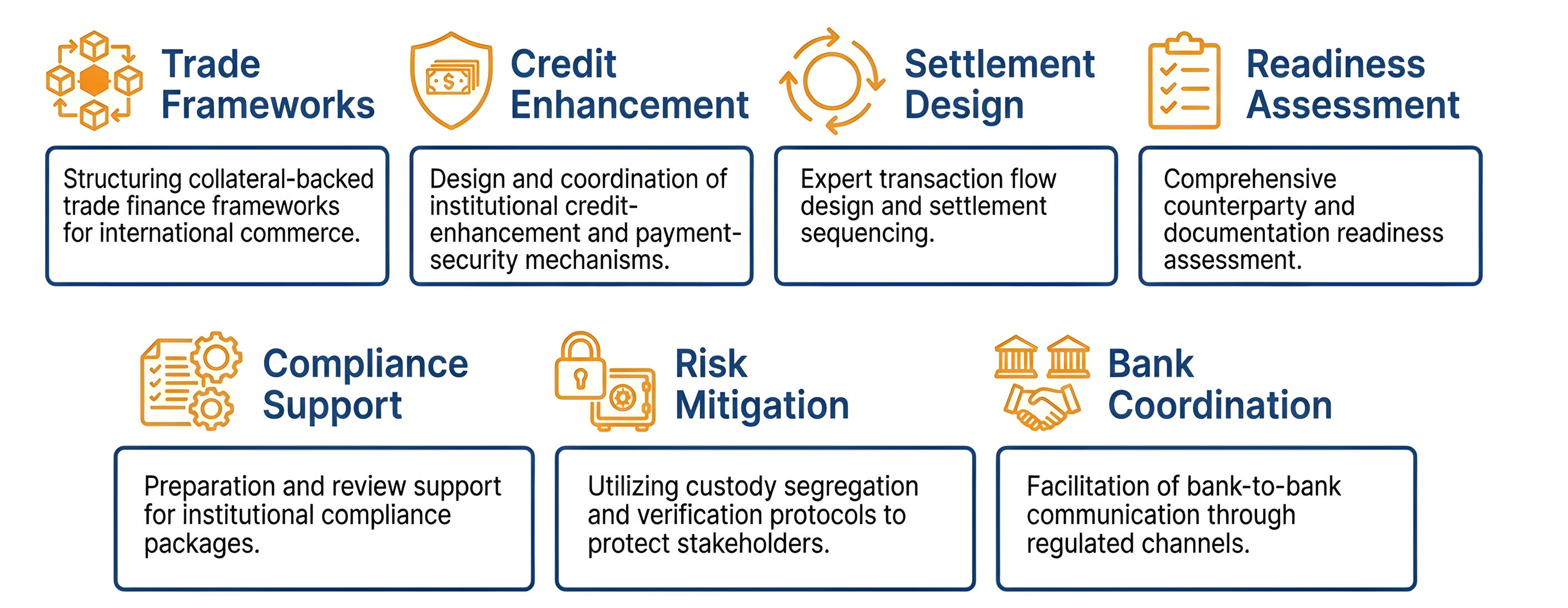

Our Core Capabilities

Custody & Capital PolicyAll client funds and financial instruments remain under the direct custody and control of the client and their appointed financial institutions at all times. Cosmo House never takes possession of client capital, never pools funds, and never manages or deploys assets on a discretionary basis.Cosmo House does not advertise, market, or promise investment returns. We do not offer investment products, trading programs, or financial instruments to the public. Any services we provide relate exclusively to commercial trade activity.

Legal & Compliance NoticeCosmo House LLC is not a registered investment advisor, securities dealer, broker, or fund manager. We do not provide financial advice, manage assets, solicit public investment, or make representations regarding financial performance or investment outcomes. All information provided is for informational purposes only and relates solely to trade finance structuring and transaction support services. Clients are encouraged to consult their own legal, financial, and banking advisors before entering into any transaction. Cosmo House LLC’s role is limited to facilitation, coordination, and advisory support within commercial trade and trade finance operations.

The Five Principles of Our Approach

Institutional CollaborationWe assist clients in navigating the operational and regulatory complexity inherent in cross-border trade—particularly where multiple jurisdictions, currencies, and banking systems are involved.We work alongside:

Regulated banks and financial institutions

Client-appointed legal and compliance advisors

Trade documentation and settlement professionals

Logistics, inspection, and delivery counterparties

Inquiries & Initial ConsultationsIf you would like to explore whether Cosmo House is a suitable partner for your trade finance or transaction structuring needs, we welcome you to reach out.All inquiries are handled with discretion. An initial conversation does not constitute a commitment or engagement.Initial discussions cover:

The nature of your commercial transaction

Jurisdictions and counterparties involved

Existing banking relationships

Proposed trade and settlement structures

Adherence to Legal & Regulatory Frameworks

Cosmo House LLC operates with a strong commitment to legal integrity, regulatory awareness, and institutional standards of conduct. Compliance is embedded in how we design transactions, evaluate counterparties, and support execution across global markets.We work alongside regulated banks, legal advisors, and compliance professionals to ensure that every engagement is structured in accordance with applicable laws, international trade practices, and professional governance expectations. Our role is to support transparent, compliant, and operationally sound transaction frameworks that meet institutional requirements.Cosmo House does not act as a financial institution, investment manager, broker, or custodian. We do not hold client funds, manage capital, or offer investment products. All settlement, custody, and financial flows remain under the control of client-appointed banks and regulated financial institutions. This operating model ensures neutrality, transparency, and protection of client capital at all times.

Legal & Compliance NoticeCosmo House LLC is not a registered investment advisor, securities dealer, broker, or fund manager. We do not provide financial advice, manage assets, solicit public investment, or make representations regarding financial performance or investment outcomes. All information provided is for informational purposes only and relates solely to trade finance structuring and transaction support services. Clients are encouraged to consult their own legal, financial, and banking advisors before entering into any transaction. Cosmo House LLC’s role is limited to facilitation, coordination, and advisory support within commercial trade and trade finance operations.

Our compliance framework is built around:

Risk-first transaction design and execution discipline

Counterparty integrity and due diligence readiness

Documentation accuracy and operational transparency

Anti-Money Laundering (AML) and sanctions awareness

Anti-bribery and anti-corruption standards

We reserve the right to decline or discontinue any engagement that does not meet our legal, ethical, or compliance standards. Protecting the integrity of our operations and the security of our clients’ transactions takes priority over commercial opportunity.

Code of ConductOur Code of Conduct defines the ethical principles, professional standards, and compliance obligations that govern all activities at Cosmo House LLC. It reflects our commitment to disciplined execution, institutional credibility, and responsible global trade.The Code applies to all employees, contractors, and representatives of the firm and outlines our approach to:

AML and sanctions compliance

Market integrity and fair competition

Confidentiality and data protection

Counterparty standards and documentation integrity

Anti-bribery and corruption prevention

Risk management and professional conduct

Initial Inquiry

Engage with Cosmo House to coordinate strategic oversight for your enterprise, project, or industry-specific ventures. We provide the specialized framework necessary to scale operations within your sector.For formal correspondence or to request a consultation, please direct all inquiries to [email protected] or utilize the submission form below.

Commodities & Market Access

Cosmo House originates and coordinates qualified supply and demand across select global commodity markets. We combine product expertise with institutional execution frameworks, ensuring that each commodity program is structured for compliance, bank compatibility, and reliable delivery.Cosmo House maintains a curated portfolio of industrial and agricultural commodities selected for their strategic importance within global supply chains. We serve as the architectural bridge between supply and demand, ensuring that every category within our coverage is governed by rigorous material standards, compliance discipline, and institution-grade execution frameworks.Explore our commodity categories below to view technical specifications and execution standards.

Industrial Metals & Materials

Aluminum

Infrastructure-grade iron products aligned with international metallurgical standards.

Silver

Industrial grade silver coordinated under strict custody and documentation protocols.

Copper

High-conductivity copper materials aligned with industrial/manufacturing specifications.

Gold

High-purity bullion sourced & moved within institutional banking & secure vaulting.

Iron

Infrastructure-grade iron & concentrate aligned with international metallurgical standards.

Hot Rolled Coil (HRC)

Structural steel coils produced under ISO & ASTM grade requirements.

Cold Rolled Coil (CRC)

Precision-finished steel coils for manufacturing and fabrication systems.

Galvanized Steel Coil

Corrosion-resistant steel products designed for construction & industrial fabrication.

Steel Billet

Semi-finished steel products structured for institutional execution and quality verification.

Railway Steel

Heavy-duty rail steel manufactured for high-load transport and infrastructure systems.

Rebar Steel Wire

High-tensile reinforcement materials designed for structural engineering & construction.

Manganese

High-grade electrolytic & alloy-grade manganese for specialized applications.

Strategic Minerals & Specialty Materials

Iridium

High-purity platinum group metal for advanced tech, medical & industrial applications.

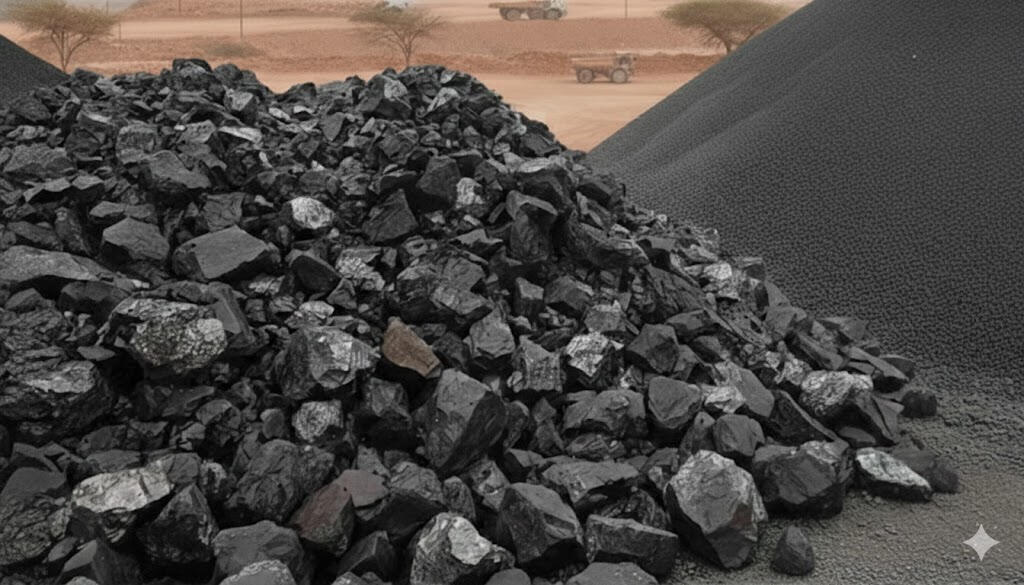

Coal

Institutional-grade thermal & metallurgical coal structured for energy & steel production.

Lithium

Battery-grade minerals aligned with semiconductor & electric vehicle manufacturing.

Palladium

Industrial-grade platinum group metal for emission control & electronics manufacturing.

Barite

High-density industrial minerals sourced for manufacturing & energy sector applications.

Dolomite

High-purity magnesium limestone structured for metallurgical, glass-making, & chemical use.

Polymers & Industrial Inputs

HDPE

High-density polyethylene resin for high-tensile industrial & infrastructure applications.

PP (Homo/Copo/Random)

Polypropylene resins engineered for heat resistance & industrial manufacturing.

PET

High-purity thermoplastic polyester for food-grade packaging & textile industrial inputs.

LDPE / LLDPE

Low-density polyethylene resins for specialized packaging & industrial film extrusion.

PVC

Polyvinyl chloride resins for rigid infrastructure & flexible industrial applications.

Rubber

Industrial-grade natural & synthetic elastomers for automotive & manufacturing systems.

MDPE

Medium-density polyethylene for mechanical properties in gas & water distribution systems.

GPPS / HIPS

General purpose & high-impact polystyrene for precision fabrication & structural casing.

Agricultural & Soft Commodities

Rice

Global food security staple structured for high-volume institutional supply & distribution.

Corn (Maize)

Industrial & feed-grade maize programs for energy, livestock, & food processing.

Wheat & Flour

Core milling & industrial wheat grades for international bakery & manufacturing standards.

Oats & Grains

Specialized cereal grains for industrial food processing & nutritional manufacturing.

Meats & Seafood

Protein supply chains focused on cold-chain integrity & international health & safety.

Coffee

Commercial & specialty grade coffee beans for industrial roasting & retail supply chains.

Beans

High-protein pulse varieties for institutional food program requirements.

Soybeans

Oilseed & protein inputs aligned with global livestock feed & processing requirements.

Butter

Industrial-grade dairy fats for commercial food manufacturing & confectionery use.

Animal-Derived Materials

Industrial animal by-products (Hides, Wool, Fats) for leather, textile, & chemical sectors.

Sugar

Refined & raw cane/beet sugar programs for industrial manufacturing & global trade.

Honey

High-purity natural sweeteners for food-grade & pharmaceutical manufacturing.

Syrup

Specialized industrial sweeteners & saps for beverage & food-processing inputs.

Cooking Oil

Refined vegetable oils (Sunflower, Agricultural) for high-volume commercial & food use.

Industrial Metals & Materials

Focusing on infrastructure-grade metallurgy and base metals essential to global manufacturing and construction supply chains. We coordinate institutional-scale programs for steel and non-ferrous materials that meet rigorous international ISO and ASTM standards, supported by verified production, inspection, and execution frameworks.

Aluminum

Infrastructure-grade iron products aligned with international metallurgical standards.

Silver

Industrial grade silver coordinated under strict custody and documentation protocols.

Copper

High-conductivity copper materials aligned with industrial/manufacturing specifications.

Gold

High-purity bullion sourced & moved within institutional banking & secure vaulting.

Iron

Infrastructure-grade iron & concentrate aligned with international metallurgical standards.

Hot Rolled Coil (HRC)

Structural steel coils produced under ISO & ASTM grade requirements.

Cold Rolled Coil (CRC)

Precision-finished steel coils for manufacturing and fabrication systems.

Galvanized Steel Coil

Corrosion-resistant steel products designed for construction & industrial fabrication.

Steel Billet

Semi-finished steel products structured for institutional execution and quality verification.

Railway Steel

Heavy-duty rail steel manufactured for high-load transport and infrastructure systems.

Rebar Steel Wire

High-tensile reinforcement materials designed for structural engineering & construction.

Manganese

High-grade electrolytic & alloy-grade manganese for specialized applications.

Strategic Minerals & Specialty Materials

Targeting critical minerals required for advanced manufacturing, medical, and technology sectors. Our origination programs focus on high-purity materials where documentation integrity, traceability, and compliance-ready execution frameworks are paramount.

Iridium

High-purity platinum group metal for advanced tech, medical & industrial applications.

Coal

Institutional-grade thermal & metallurgical coal structured for energy & steel production.

Lithium

Battery-grade minerals aligned with semiconductor & electric vehicle manufacturing.

Palladium

Industrial-grade platinum group metal for emission control & electronics manufacturing.

Barite

High-density industrial minerals sourced for manufacturing & energy sector applications.

Dolomite

High-purity magnesium limestone structured for metallurgical, glass-making, & chemical use.

Polymers & Industrial Inputs

Coordinating institutional-grade supply programs for industrial feedstocks and manufacturing polymers. We align global production with industrial demand through controlled logistics, material verification, and quality-assurance standards across a wide range of resin grades.

HDPE

High-density polyethylene resin for high-tensile industrial & infrastructure applications.

PP (Homo/Copo/Random)

Polypropylene resins engineered for heat resistance & industrial manufacturing.

PET

High-purity thermoplastic polyester for food-grade packaging & textile industrial inputs.

LDPE / LLDPE

Low-density polyethylene resins for specialized packaging & industrial film extrusion.

PVC

Polyvinyl chloride resins for rigid infrastructure & flexible industrial applications.

Rubber

Industrial-grade natural & synthetic elastomers for automotive & manufacturing systems.

MDPE

Medium-density polyethylene for mechanical properties in gas & water distribution systems.

GPPS / HIPS

General purpose & high-impact polystyrene for precision fabrication & structural casing.

Agricultural & Soft Commodities

Coordinating institutional-grade agricultural and food commodity programs across global markets. Our focus is on high-volume products that require strict adherence to phytosanitary standards, cold-chain integrity, independent inspection protocols, and structured delivery sequencing within regulated international supply chains.

Rice

Global food security staple structured for high-volume institutional supply & distribution.

Corn (Maize)

Industrial & feed-grade maize programs for energy, livestock, & food processing.

Wheat & Flour

Core milling & industrial wheat grades for international bakery & manufacturing standards.

Oats & Grains

Specialized cereal grains for industrial food processing & nutritional manufacturing.

Meats & Seafood

Protein supply chains focused on cold-chain integrity & international health & safety.

Coffee

Commercial & specialty grade coffee beans for industrial roasting & retail supply chains.

Beans

High-protein pulse varieties for institutional food program requirements.

Soybeans

Oilseed & protein inputs aligned with global livestock feed & processing requirements.

Butter

Industrial-grade dairy fats for commercial food manufacturing & confectionery use.

Animal-Derived Materials

Industrial animal by-products (Hides, Wool, Fats) for leather, textile, & chemical sectors.

Sugar

Refined & raw cane/beet sugar programs for industrial manufacturing & global trade.

Honey

High-purity natural sweeteners for food-grade & pharmaceutical manufacturing.

Syrup

Specialized industrial sweeteners & saps for beverage & food-processing inputs.

Cooking Oil

Refined vegetable oils (Sunflower, Agricultural) for high-volume commercial & food use.